Maximizing the ROI of Your Accounting Firm’s Client Experience Starts with Three Simple Steps

For decades, many accounting firms have focused on providing “good service” to their clients and viewed doing so as a benevolent act or a “soft skill” without a quantifiable impact on the bottom line or a true competitive advantage. However, the definition of “good service” has changed dramatically over the past few years—and it continues to do so at a rapid rate. This is driven in large part by accounting technology and its impact on client expectations.

Consider the “Amazon effect” on how many clients now look for, engage with and, ultimately, purchase products and services. Gone are the days when waiting for a phone call to get what you need was the norm—technology has made service quality, immediacy and convenience the price of doing business. If your firm can’t deliver, it’s easy for clients to make the decision to choose a different firm that can.

This is why a focus solely on “good client service” is missing a key return on investment (ROI) opportunity—one that can only be gained with a deep commitment to providing an ideal client journey.

What does the client journey at your firm look like?

The client journey refers to the series of touch-points between your firm and its clients which exist from the initial discovery phase through onboarding and active service of a client through the time when the relationship ends. The quality of these interactions, viewed through the eyes of a client, is commonly called the customer experience (CX). Actively managing this entire end-to-end process is the key to maximizing the ROI it offers.

How will your firm create a seamless and profitable client experience?

Keeping up with client expectations influenced by the explosion and evolution of online product and service delivery and the growing consumer preference supporting them is a challenge for many firms. For example, to remain competitive, accounting practices must offer on-demand access to what and who clients need or risk disappointment and irritation across their client base.

Over time, unresolved pain points and bottle necks in the client journey can erode even the most forgiving and devoted client relationships. Clearly, your firm’s CX must keep pace with trends in the marketplace—especially those in markets outside of the accounting profession because your clients will compare these experiences with those they have with your firm.

Download the free white paper, Adopting a Transformative Practice Management Mindset, and learn how to build a better practice by taking a systematic approach to client service and operations.

Download the free white paper, Adopting a Transformative Practice Management Mindset, and learn how to build a better practice by taking a systematic approach to client service and operations.

Three simple steps can help your firm maximize CX ROI

From an internal perspective, providing a seamless and satisfying CX driven by your firm’s client-centric culture and supporting technology, including a cloud-based practice management platform will also improve productivity and efficiency, which in turn increases your firm’s ROI in this area. So how can your firm put in place the building blocks to leverage the benefits of a better CX?

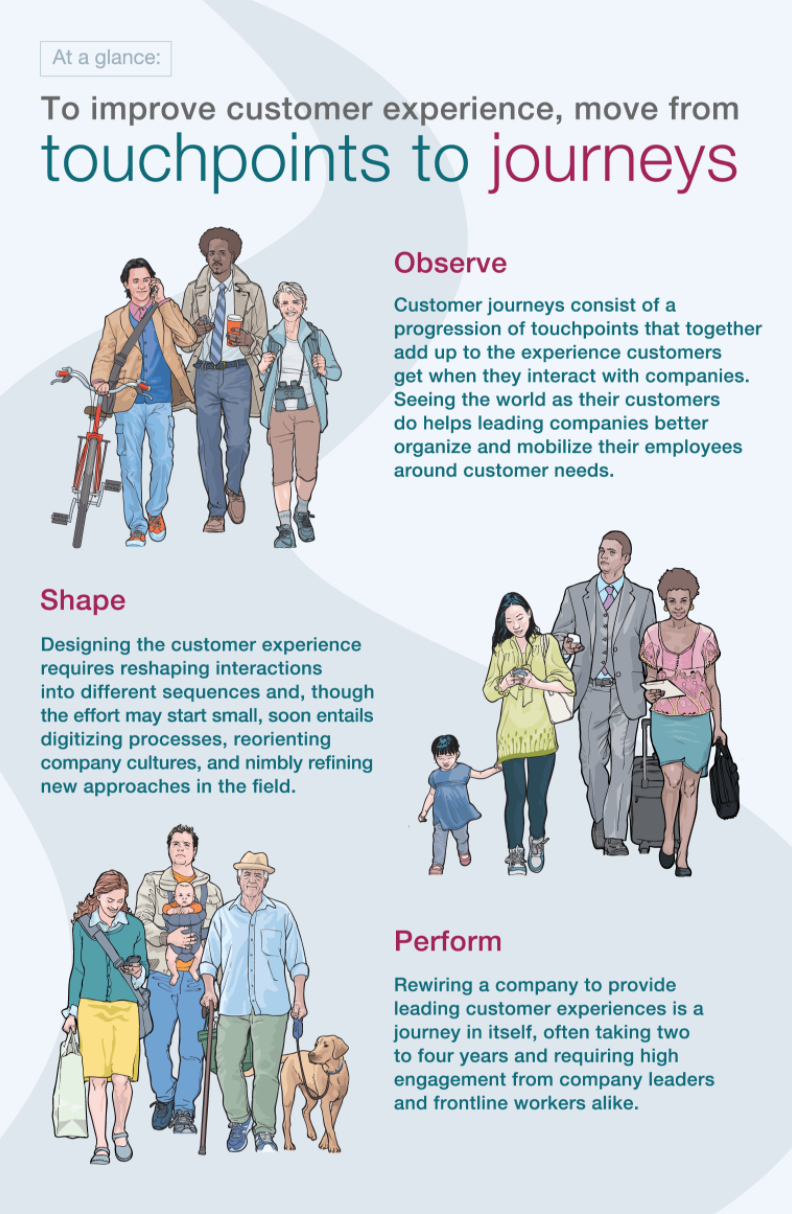

Consulting firm McKinsey provides an effective and easy-to implement CX framework built on three simple steps:

Consulting firm McKinsey provides an effective and easy-to implement CX framework built on three simple steps:

- Observe your current CX to identify pain points, bottlenecks and other changes that need to be made. It is important to think about how you attract, win and serve clients through their eyes. Are you making it easy to find and do business with your firm? Are you delivering the services clients expect in a way that is seamless and creates goodwill? These are just a few questions to think about as you work to refine your firm’s client journey.

- Shape a new client experience using the insights gained in your observations. Once data has been analyzed across the multiple touchpoints of your firm’s overall CX, it’s time to look at the specific areas where changes are needed. This could mean investing in additional technology, changing processes or creating a better feedback loop with your clients.

- Perform every function in your firm from a CX perspective. As the process of mapping your client journey and creating a ROI-enhancing CX unfolds, it is critical to embed a client-centric culture in every area of your operations. From the sales process to onboarding and service delivery through billing and beyond, all of these functions must be designed to create value for clients and reduce any “friction” in the business relationship between them and your firm.

Measure, analyze, and adjust

Once you have taken the steps above, the next task is to measure the ROI associated with your actions to create an improved CX. Being able to measure the quantitative gains you have made in key areas such as client profitability, services per client, client retention, new client onboarding and average revenue per year per client can be challenging without a practice management platform.

The practice management technology your firm uses should provide tools to elevate your firm’s CX including cloud-based client portals as well as on-demand access to financial information. Also, it must offer the ability to track and report meaningful data about each touchpoint between your firm and prospective and existing clients.

Without these two capabilities, accessing aggregate data over time to understand the gains your firm has made and where improvements are still needed in your firm’s client journey is almost impossible. These insights can be invaluable in helping you maximize your ROI while sharpening your competitive edge in attracting and retaining clients.